When we purchased our first house we put down a large down payment. Our realtor was surprised to find out we didn't have any other debt. Getting the loan was no problem as we bought quite a bit less house than what the banks said we could afford. This all seemed normal for us--we try to live within our means if not a little below it. Several years later the realtor stopped by to say hi. He said, "You and your wife were really an inspiration to me. We've started paying off our debt and trying to get our living expenses under control." Evidently his normal customers weren't people who lived beneath their means. When you spend less than you make, you are buying flexibility and freedom. … [Read more...] about Living Within Your Means

finances

AT&T DSL Only Option

AT&T is offering DSL without requiring phone service. This is sometimes referred to as "dry dsl" or "naked dsl". For about $29 per month, you can get 3.0Mbps down and 512Kbps up high speed internet connection. This also gives you free internet service from AT&T's wireless access points across the US. This service would normally cost $39 per month, so if you need it, this can work out to be a very good deal. In my area of the country they also offer 6.0/768k internet service for about $34 per month. This is what I used before we bought a house that is a few hundred feet from where AT&T offers service. This "DSL without phone service" package has been around for … [Read more...] about AT&T DSL Only Option

10 Stages of Financial Freedom

0. You Earn Less than you Spend This is obviously a good place to avoid and represents the least amount of freedom. No one should be here, but I added it because I know many people (particularly in the US) operate regularly in this stage. 1. Your Job Covers Your Expenses This is where a lot of people are. You spend everything you make. At this stage, losing your job is a terrifying prospect because you are only a week or two away from being back in stage 0. A few more weeks, (depending on how long you can string out your credit cards) and you'd be looking at bankruptcy. At this stage, changing jobs is very risky because, if it doesn't work out, you have very little cushion to let … [Read more...] about 10 Stages of Financial Freedom

Working with Your Spouse Financially

In the book The Millionaire Mind and The Millionaire Next Door, the authors point out that millionaires tend to marry people who support them financially. One of the easiest ways to wreck your financial plan is for there to be competition between a husband and wife, financially. If you have ever heard a couple say things like, "well, you bought a new dvd player, so I can go buy a new dress" or "you spent $300 at the mall, so I decided to go buy a new television." You know what I'm talking about. If the members of a marriage feel like they are in competition with each other for spending, they are off to a bad start. Here are some simple tips to avoid this type of … [Read more...] about Working with Your Spouse Financially

Upper, Lower and Middle Class Tax Breaks

Many people feel that rich people don't pay enough taxes. The question of what type of tax structure is best for the economy isn't something I want to address in this post. Instead, I'd like to talk about the idea that rich people pay less in taxes than the poor and middle class. Part of this view is rooted in what people see as the purpose of taxes. I see the government as providing a very valuable service to me. They keep the infrastructure running and create the rules and environment that allow me to live happily and run a profitable business. I am happy to pay taxes to support the police and military to keep me safe, pave roads to drive on, help prevent the outbreak of horrible … [Read more...] about Upper, Lower and Middle Class Tax Breaks

14 Must-Have Online Banking Features

Our daughter just turned 3 months old. She has already visited 10 states and she's spent 1/3rd of her life on the road with us. My point is, we travel a lot. We need to be able to manage our finances from anywhere in the world. Rich online banking services are much more important than a physical location. Since I have been doing all of my banking online with quite a few different online banks as I looked for the best solution, I've had a chance to really experiment with what works and what doesn't work for us. Here is a checklist of things to look for in an online bank. Some items you may be familiar with. Others might be new to you if it isn't something your current bank … [Read more...] about 14 Must-Have Online Banking Features

Saving Money on Cooling Your Home

Dealing with the summer heat can be pretty expensive. The colder you need to keep your house, the more it costs. Here are some tips to help you stay cool at home more efficiently. Dress light - Make sure you are wearing cool clothing in your home. Wearing long sleeves and warm pants is going to force you to keep the temperature colder to stay comfortable. If dressing in cooler clothes lets you turn the thermostat up even just a single degree, it can still result in significant savings. Take off your shoes - This is related to dressing light, but if your feet are cool, it is much easier to feel cool all over. A cheap pair of sandals to wear inside can pay for themselves very … [Read more...] about Saving Money on Cooling Your Home

Reducing Expenses vs. Being Productive

We usually think of being more productive as a way to make more money, or at least make the same amount of money with less effort. This is a short sighted approach. Being more productive really means doing things that will give you more time to pursue the things that are really important to you. If I am able to maintain my same level of pay and cut my work time in half, I've made some pretty significant improvements in my productivity. But what if, instead of maintaining the same level of pay, we just try to maintain the same standard of living. Or better yet, just maintain the same standard of living on things that are important to us. This type of thinking suddenly opens up … [Read more...] about Reducing Expenses vs. Being Productive

Productive Finances Checklist

Here is a checklist for your financial productivity. Most of these things seem minor, but taken together, they really add up and can make a big difference in how efficiently you are using your time and money. Are you using direct deposit for your paychecks? -- If you are still manually carrying a check to the bank or putting it in the mail, stop! Direct deposit will get your money to the bank faster so you start earning interest as soon as possible. Even if it only saves you 5 minutes every two weeks, that is an extra 2 hours each year you can spend on something more important. Is your money in the bank earning at least 4% interest? -- If not, look for a different account. There … [Read more...] about Productive Finances Checklist

Fewer Financial Institutions

Last year I finally got fed up with all the statements I was getting from various financial institutions. I had retirement accounts with 4 or 5 different companies and stock accounts with 2 or 3 others. It was very difficult to keep track of what was doing well and what was doing poorly. I finally settled on two institutions; one for retirement type accounts and one for my non-retirement savings, checking and investments. I contacted both institutions and gave them a list of what I wanted to move over. On the retirement side of things, the transition went very smoothly. They filled out all the paperwork, sent it to me for my signature and I FedExed it back to them. The … [Read more...] about Fewer Financial Institutions

Keeping Your Stuff Safe

The other day, I stepped outside and found my neighbor lugging a broken door out of his garage and into the back of his pickup truck. It turns out he had locked himself out of his house. His wife was away and he had no spare keys. To make matters worse, their new puppy was inside the house. He simply kicked the door in, got his keys and then went and purchased an identical door, which I helped him install. Later on that day, I was talking with some other neighbors who are both police officers. They were staring at the mangled door next to the curb and wondering what happened. They commented that the doors and locks on our houses don't really keep our possessions safe. For the … [Read more...] about Keeping Your Stuff Safe

4 Reasons You Should Use a Credit Card

When you pay off the balance each month, most credit cards don't charge you anything. This can be one of the best ways to manage your finances. Below are four reasons you should consider using a credit card. 1. Avoiding Fraud Debit cards and checks are some of the worst ways to pay for anything. Sticking with credit cards or cash can save you a lot of money. Pretty much anything you do involves risk. When you carry around $50 in your pocket, there is a risk that you might lose it or get robbed. When you give a credit card to a waitress, there is a risk that she might steal the number. When you write a check at the grocery store, there is a risk that someone might take your … [Read more...] about 4 Reasons You Should Use a Credit Card

Wrong Side of the Tracks

The town where I live has a railroad track running through middle. In general, the nicer houses are on the West side of the town and the older, more run down houses are on the East side. Our evening entertainment usually consists of going for walks down the brick-paved streets. The town is small, so you can cover a significant portion in a few 3 mile walks. One thing we've noticed is that the average number of dogs per house on the less affluent side of the tracks is much higher than on the wealthy side of the tracks. On the East side, it is common to see 3 or 4 dogs staked out together in a small yard. On the West side of the tracks, people still have dogs, but it is rare to see … [Read more...] about Wrong Side of the Tracks

FDIC Insurance – When Banks Fail

This post was originally published October 29th, 2007. I'm bumping it up because in today's financial climate it is extremely important. If you have any experience in dealing with getting money back from FDIC, please read the comments. Several people are having problems getting their money. Any advice you can give would help them out. Recently NetBank was shut down by the FDIC. The FDIC was created to prevent runs on the bank. They insure your accounts so even if the bank goes under, you will get your money back out. In exchange the bank gives up some control. The FDIC can come in, inspect things and force the bank to sell out to another financial institution if the FDIC doesn't … [Read more...] about FDIC Insurance – When Banks Fail

Six Tips for Eating Out Frugally

Most of the time, people go out to eat, not just for the food, but for social and entertainment purposes. These six suggestions will help you get the experience at a "discount". Order water - In the US, you'll usually pay $1 to $3 for a soft drink with your meal. Water is healthier and can often reduce the cost of your meal by 10% to 20%. Go out for lunch - Many places charge more for the evening meal than for lunch. Sometimes the evening portions are bigger, but this isn't always the case. If you go out for lunch you'll often save 35% to 50% on your meal. (This seems to be particularly true for Chinese restaurants.) Go out just for dessert - Eating at home and going out for … [Read more...] about Six Tips for Eating Out Frugally

Bank Mistake

I have a bank that didn't get my last change of address notification. When the mail was returned to them, they found my address and sent it to me along with a note telling me to change my address with them. The odd thing was along with my statement were 5 other statements from people I don't know. I called them and confirmed the address change and mentioned the other statements. They said they would take care of it. The other day I got my next statement--and the statements from 5 different people I've never heard of. I don't mind getting other people's statements. However, I'm very concerned that some of my statements may be sent to total strangers. This is one advantage of online … [Read more...] about Bank Mistake

Asking for a Discount

One way to realize great savings is to simply ask for a discount. For example, when we were getting ready for our daughter to be born we asked the hospital if we could have a discount for paying the entire fee up front. They gave us 20% off what we would have paid otherwise. I've generally had good luck asking for discounts. Here are some tips to follow: Make sure you have something to offer - If you can pay in cash, but in bulk or offer some other type of incentive it is easier for the person selling to want to negotiate with you. Be prepared to walk away - If the sales person realizes that you might not make the purchase you have much better bargaining power. I've had car … [Read more...] about Asking for a Discount

Credit Card Skimming

Today I got a call from my credit card company wanting to verify a few charges. They listed several purchases from a part of the country we haven't visited for years. The charges were all from a card that we don't use any more--we keep it just for emergencies (if other cards are declined or stolen). My wife and I both have our cards so it seems someone "skimmed" the number. Hi tech thieves will find a waiter or waitress and offer them $5 or $10 for each card they run through a small hand-held device. The thief then takes the device and downloads all the numbers into a computer and offers them for sale on the internet. Usually this will be done in a batch of cards say 100 or 1,000 card … [Read more...] about Credit Card Skimming

Books

Earlier today I mentioned a book by the Wall Street Journal about personal finance, but failed to actually point people to the book. I've added the book to the Productivity501 store. The book is designed to give you a good financial foundation. It doesn't go into great depth on subjects, but it seems to do a great job of making sure you aren't missing anything in your financial foundation of understanding. Another book that I'd recommend is called Founders At Work. It is a series of interviews with people who started various companies. It is a great read and very enlightening to hear the stories behind all these different businesses. One thing I've been fascinated by in the book … [Read more...] about Books

Being Financially Literate

One of the best investments you can make in yourself is to increase your financial literacy. In fact if you only have 10 hours this year that you can invest in self-improvement there are very few ways you can better spend that time than reading a book on investing and financial management. Go ahead and take the time to visit your library and find a few books on investing and financial management. Even if you just skim the parts that look interesting you'll find this small investment can make a big difference in your ability to plan financially for the future. The Wall Street Journal has a good book on investing that I'd recommend. What do other people suggest? Is there a financial … [Read more...] about Being Financially Literate

Passive Income

Last week we talked about defining wealth in terms of long you can go without a job before running out of money. With this definition of wealth we can increase our wealth from two sides. One side is to reduce our spending the other is to increase our savings and our income that isn't tied to work. Money that you don't have to work for is usually called passive income. This includes interest and other types of income that you get more or less automatically. Here is a list of some passive income sources: Interest income - Money that the bank pays you for the use of your money. Rental income - Real estate lease or other sources of income in exchange for the use of property. Royalties … [Read more...] about Passive Income

Definition of Wealth

One of the most important things you can do in aligning your finances to be more productive is define what wealth means to you. Obviously being wealthy is something of a relative term. Someone at the poverty line in the US would be seen as extremely rich in other parts of the world. The Rich Dad Poor Dad books give an interesting definition of wealth. They say that wealth is determined by how long you can survive at your current standard of living if you quit your job today. So once you stop getting your regular paycheck, how long can you live off your savings and passive income sources before you go broke. I think this is a very healthy description of wealth because instead of … [Read more...] about Definition of Wealth

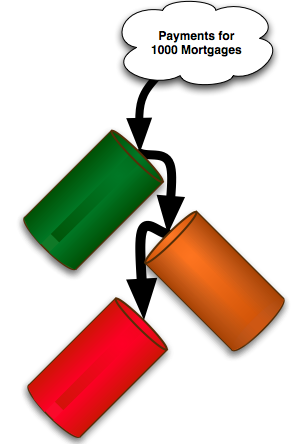

Subprime Problem Explained

Thanks to everyone who helped answer my questions in the previous subprime post I now have a much better understanding of what is going on. I thought I'd go ahead and explain it here. The first reason is to share with anyone who is interested. The second is so the financial wizards among my readers can correct me if I got anything wrong. Over the past several decades home prices have been going up. This has made them a fairly safe investment. If someone can't make their payments they can always sell the house--usually at a profit--and pay the mortgage company back. In order to create as many loans as possible, mortgage companies will take a group of mortgages and turn them into a special … [Read more...] about Subprime Problem Explained

10 Signs You Will Be Poor

Here is a list of signs that indicate someone is likely to be poor in the future. If any of these apply to you, it might want to consider making some changes. 10. The only type of CDs you know about play music. Not understanding basic investment tools is one sure sign that you will mismanage your finances. This is especially true because a basic financial education is so readily accessible on websites, through library books, etc. 9. Your bank account balance goes down each month. You don't need any fancy charts to see if your net worth is improving or decaying. If you usually have less money in your accounts each month then your lifestyle is not sustainable on your current income. You'll … [Read more...] about 10 Signs You Will Be Poor

Productivity and Finances

A lot of people tend to think of productivity in a vacuum. They want to get more done. However at the end of the day your work translates into money which translates into purchasing power. Sometimes instead of just concentrating on how to do more work, it is more efficient to concentrate on the conversion process--how the work turns into money and then turns into things you need. For example, if you currently work for $50 per hour and you are able to make a change that allows you to turn your work into money at a rate of $75 per hour, you've increased your productivity by 50%. On the other hand, if you can make your money go further you can also increase your productivity. For … [Read more...] about Productivity and Finances

Help Me Understand the Subprime Mess

I don't understand the subprime mess. I mean I understand the idea that if you try to loan a bunch of people money who are likely to default (bad credit, poor financial skills, etc.), then you have a high chance of them ... well, defaulting. That part makes sense, but the way it is causing problems for banks doesn't make sense to me. This isn't a standard productivity post, so feel free to skip this one if it doesn't interest you. It is more of a personal question to my readers who more more financially savvy than me. If you find financial markets interesting--and especially if you understand them and care to leave a comment--please read on. So lets skip the whole part of the … [Read more...] about Help Me Understand the Subprime Mess

Tuesday’s Tip: Pennies

I don't know if this is actually a productivity tip or not. It might actually waste more time than anything else, but I feel like it is a good thing. Do you have a huge collection of pennies that are building up? My wife and I have a metal box full of our loose change. We run most of our expenses through our credit cards, but we still end up with a bunch of coins. I have found a use for pennies. The toll roads in Chicago take pennies. I don't know if this works in many other major areas or not. There is something deeply satisfying about throwing 80 pennies into the machine to pay for your toll. Of course you probably don't want to sit at the toll booth counting out 80 pennies. … [Read more...] about Tuesday’s Tip: Pennies

My Experience Selecting a CPA

For the past year, I've been spending a lot of time learning about the IRS rules for income tax, particularly the rules for a business. After many hours of the IRS website and pouring through other books, I finally decided that I'd be better off sitting down with a CPA. I've talked with several and so far I'm not impressed.What I'm finding is that at least some CPAs seem to be very use to people just taking their advice and not asking any questions. A recent conversation went something like this: Me: It appears that my business can deduct X. Is that correct? CPA: No. Me: Why not? CPA: Because publication 15b says you can't. Me: I just read publication 15b and it says I can … [Read more...] about My Experience Selecting a CPA

The Child Who Has Everything

On the front page of Amazon I saw a list of items that said they were for "the child who had everything". While there were some very interesting toys, I got to thinking about that designation. It definitely isn't how I want my child described. Every parent wants to give their kids nice things and most parents try to give their kids things that they didn't have growing up. This isn't always a good thing. I'm not saying it is a bad idea to help your kids obtain a better education than what you received, but when the only thing your kid doesn't have is a $10,000 replica space suit you've got to question how well you are preparing them for the real world. A lot of my views on money were … [Read more...] about The Child Who Has Everything

HSA – Why You Need to Notice These Special Accounts

I was talking with a physician this past week about health care. I mentioned that HSAs seemed like a step in the right direction for dealing with health insurance. He gave me a blank look and I realized he didn't know what I was talking about. If a doctor doesn't know about this wonderful new tool, some of my readers would probably benefit from a 5 minute explanation. An HSA is a Health Savings Account. Most people are familiar with "flex spending" type medical savings accounts where you set aside money pre-tax in order to pay for health related expenses throughout the year. If you don't use the money for health care, you lose it at the end of the year. So if you are healthy you … [Read more...] about HSA – Why You Need to Notice These Special Accounts