Thanks to everyone who helped answer my questions in the previous subprime post I now have a much better understanding of what is going on. I thought I’d go ahead and explain it here. The first reason is to share with anyone who is interested. The second is so the financial wizards among my readers can correct me if I got anything wrong.

Over the past several decades home prices have been going up. This has made them a fairly safe investment. If someone can’t make their payments they can always sell the house–usually at a profit–and pay the mortgage company back. In order to create as many loans as possible, mortgage companies will take a group of mortgages and turn them into a special type of investment vehicle and sell them off. This gives them cash to create more loans. For example, they will take 1000 mortgages and sell the rights to receive payment off to other institutions. Since different institutions have different risk tolerances they take the investment vehicle and divide it into several different segments. The first segment gets paid first. The second gets any money left over and the third gets any money left over from the first and second segments.

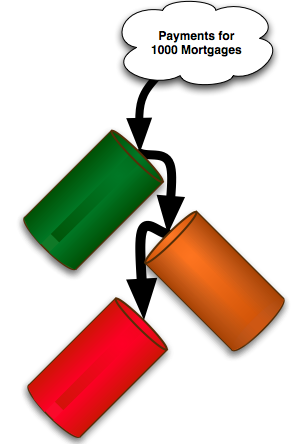

So when money come in from people paying on their loans, it first goes into the green bucket. The green bucket is sold to institutions who want very little risk. If the people who bought the green bucket have already received their money the payment goes to the orange bucket and so on.

So when money come in from people paying on their loans, it first goes into the green bucket. The green bucket is sold to institutions who want very little risk. If the people who bought the green bucket have already received their money the payment goes to the orange bucket and so on.

This makes the green bucket very very safe. 66% of the mortgages would have to go into default before it would matter to the people who own the green bucket. The orange bucket only requires that 33% go into default before they start loosing money. If anyone doesn’t pay, the red bucket starts losing money.

This arrangement is why there are companies willing to sell their investment for $0.30 on the dollar. If they own the red bucket there is a good chance they will get very little of their money back.

Originally I didn’t understand why companies would be willing to sell their mortgage backed securities for 1/3rd of their face value. As you can see they don’t actually own the mortgage, they own a position to receive the payment from the mortgage.

This is causing some problems because the people who will lose money if homeowner stop paying are not they ones who actually hold the deed. In at least once instance, courts have ruled that the banks who purchased the mortgage backed securities can’t foreclose because they aren’t actually the owners of the property. So there are people living in homes that they have simply stopped paying the mortgage on and it doesn’t look like they will get kicked out any time soon.

For people (like me) who would be interested in investing in real estate if the prices drop significantly, it doesn’t look like things have hit bottom. The housing market is going to stay relatively high until a bunch of foreclosures start flooding the market. This is already happening in Detroit and some other cities, but most home prices are still within 10% of where they have been in the last 3 or 4 years.

So did I explain it correctly? Are there any major points to the way these investments were structured that I misunderstood?

Another reason why this whole mess is happening is because Congress required lenders to give loans to high-risk borrowers.

Many high-risk borrowers + variable interest rates = many defaults

Good explanation of how mortgages are converted into securities that can then be resold to investors.

I would add the role that the rating agencies and analysts played in all of this. Using mathematical models (which we now know were deeply flawed), the various buckets in your example were given very high ratings (AAA, AA or A grade). Even the red bucket got a high rating.

This allowed very large investors, such as state pension funds, to purchase these securities, since they have rules that only let them buy safe investments. With the stock market in the doldrums and interest rates on CDs very low, these mortgage backed securities looked like a good, safe investment. The money started pouring in.

This resulted in pressure on the mortgage companies to generate more of the stuff to meet demand. That is what led the mortgage companies to relax their lending standards and make more and more sub-prime loans.

Now, many of the loans have gone bad. As your bucket example clearly shows, the people owning the red bucket will get nothing, even the yellow bucket looks dangerous. As you point out, the actual ownership of the mortgage is in doubt, so the investors don’t even have the traditional fallback position of seizing the house.

I think you are wise to stay out of the real-estate market for a while longer.

Another critical point that could almost be seen as the big bang of the housing bubble is the explosive growth around the world. The boom in many parts of the international market has not only created enormous amounts of wealth, but that wealth is highly concentrated in high net worth individuals and foreign wealth funds. With the funds they have sloshing around, the directed money management resources available to them did not do a good job at investing broadly and deeply, leading to enormous pressures on the international financial markets to “find” them places to invest their money.

With lax lending regulations, thanks to congress, US and other financial houses were giddy to “find” places for the sloshing money to seep into their system. With immense profits to be gained from money being pushed down the pipe, ethics and rules fell by the wayside. The system thus gave birth to sloppy pass-through and collateralized mortgage backed securities that were swapped and combined with the zeal of a fool. Along with the careless lending regulations, the low interest rates the Fed was pushing to spur the economy was nothing more than grease on the slip and slide

Historically speaking, US house prices have appreciated around the 3-5% mark. If your house has appreciated more since ~2003, then you might want to consider that you could be in real trouble!