Today I got a call from my credit card company wanting to verify a few charges. They listed several purchases from a part of the country we haven't visited for years. The charges were all from a card that we don't use any more--we keep it just for emergencies (if other cards are declined or stolen). My wife and I both have our cards so it seems someone "skimmed" the number. Hi tech thieves will find a waiter or waitress and offer them $5 or $10 for each card they run through a small hand-held device. The thief then takes the device and downloads all the numbers into a computer and offers them for sale on the internet. Usually this will be done in a batch of cards say 100 or 1,000 card … [Read more...] about Credit Card Skimming

Money

Reader Question – Organization & Saving

How can being organized save you money? If time is money and being organized saves you time, it saves you money. Lets say you look for 6 things each day that take you on average 5 minutes apiece. You reorganize your office and reduce the time to 1 minute search for each item. You are now saving 24 minute each day or about 146 hours each year. Even if you have to invest half of that time staying organized that still gives you 73 hours of extra time from being organized. This is an extra 9 days each year. You can reinvest your extra time back into work to try to earn more money, spend it with your family, or just take some extra time to relax. … [Read more...] about Reader Question – Organization & Saving

Books

Earlier today I mentioned a book by the Wall Street Journal about personal finance, but failed to actually point people to the book. I've added the book to the Productivity501 store. The book is designed to give you a good financial foundation. It doesn't go into great depth on subjects, but it seems to do a great job of making sure you aren't missing anything in your financial foundation of understanding. Another book that I'd recommend is called Founders At Work. It is a series of interviews with people who started various companies. It is a great read and very enlightening to hear the stories behind all these different businesses. One thing I've been fascinated by in the book … [Read more...] about Books

Being Financially Literate

One of the best investments you can make in yourself is to increase your financial literacy. In fact if you only have 10 hours this year that you can invest in self-improvement there are very few ways you can better spend that time than reading a book on investing and financial management. Go ahead and take the time to visit your library and find a few books on investing and financial management. Even if you just skim the parts that look interesting you'll find this small investment can make a big difference in your ability to plan financially for the future. The Wall Street Journal has a good book on investing that I'd recommend. What do other people suggest? Is there a financial … [Read more...] about Being Financially Literate

Reader Question – Credit Cards

Why do people use credit cards? If you have financial self discipline, using a credit card can be much safer than using cash or debit cards. Credit cards offer you better protection from fraud. They are also setup to protect your rights as a consumer because you can leverage the credit card company against a merchant who sold you a defective product. In a previous post, I discussed 4 Reasons You Should Use A Credit Card. Many people are conditioned to avoid credit cards at all costs. This is a good strategy if you have no financial discipline--just a like an alcoholic should steer clear of even driving near a bar. If you treat your credit card like a checking account and keep track of … [Read more...] about Reader Question – Credit Cards

Passive Income

Last week we talked about defining wealth in terms of long you can go without a job before running out of money. With this definition of wealth we can increase our wealth from two sides. One side is to reduce our spending the other is to increase our savings and our income that isn't tied to work. Money that you don't have to work for is usually called passive income. This includes interest and other types of income that you get more or less automatically. Here is a list of some passive income sources: Interest income - Money that the bank pays you for the use of your money. Rental income - Real estate lease or other sources of income in exchange for the use of property. Royalties … [Read more...] about Passive Income

Definition of Wealth

One of the most important things you can do in aligning your finances to be more productive is define what wealth means to you. Obviously being wealthy is something of a relative term. Someone at the poverty line in the US would be seen as extremely rich in other parts of the world. The Rich Dad Poor Dad books give an interesting definition of wealth. They say that wealth is determined by how long you can survive at your current standard of living if you quit your job today. So once you stop getting your regular paycheck, how long can you live off your savings and passive income sources before you go broke. I think this is a very healthy description of wealth because instead of … [Read more...] about Definition of Wealth

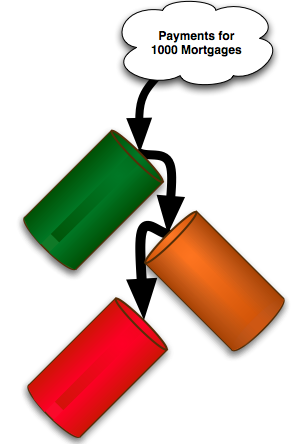

Subprime Problem Explained

Thanks to everyone who helped answer my questions in the previous subprime post I now have a much better understanding of what is going on. I thought I'd go ahead and explain it here. The first reason is to share with anyone who is interested. The second is so the financial wizards among my readers can correct me if I got anything wrong. Over the past several decades home prices have been going up. This has made them a fairly safe investment. If someone can't make their payments they can always sell the house--usually at a profit--and pay the mortgage company back. In order to create as many loans as possible, mortgage companies will take a group of mortgages and turn them into a special … [Read more...] about Subprime Problem Explained

10 Signs You Will Be Poor

Here is a list of signs that indicate someone is likely to be poor in the future. If any of these apply to you, it might want to consider making some changes. 10. The only type of CDs you know about play music. Not understanding basic investment tools is one sure sign that you will mismanage your finances. This is especially true because a basic financial education is so readily accessible on websites, through library books, etc. 9. Your bank account balance goes down each month. You don't need any fancy charts to see if your net worth is improving or decaying. If you usually have less money in your accounts each month then your lifestyle is not sustainable on your current income. You'll … [Read more...] about 10 Signs You Will Be Poor

Productivity and Finances

A lot of people tend to think of productivity in a vacuum. They want to get more done. However at the end of the day your work translates into money which translates into purchasing power. Sometimes instead of just concentrating on how to do more work, it is more efficient to concentrate on the conversion process--how the work turns into money and then turns into things you need. For example, if you currently work for $50 per hour and you are able to make a change that allows you to turn your work into money at a rate of $75 per hour, you've increased your productivity by 50%. On the other hand, if you can make your money go further you can also increase your productivity. For … [Read more...] about Productivity and Finances

HSA – Why You Need to Notice These Special Accounts

I was talking with a physician this past week about health care. I mentioned that HSAs seemed like a step in the right direction for dealing with health insurance. He gave me a blank look and I realized he didn't know what I was talking about. If a doctor doesn't know about this wonderful new tool, some of my readers would probably benefit from a 5 minute explanation. An HSA is a Health Savings Account. Most people are familiar with "flex spending" type medical savings accounts where you set aside money pre-tax in order to pay for health related expenses throughout the year. If you don't use the money for health care, you lose it at the end of the year. So if you are healthy you … [Read more...] about HSA – Why You Need to Notice These Special Accounts