Some time back I wrote an article called You Are Self-Employed. The premise was that being an employee doesn't really offer any job security and if it doesn't offer job security, you may want to consider starting your own business. I also mentioned that it is probably easier to start a business today than it ever has been. The comments were where things got interesting though. It turns out a lot of people think of starting a business as something that requires huge amounts of capital. But not every company requires millions of dollars to start--particularly if you are willing to be creative. This past week I got a call from a company that is doing just that--being very creative. They … [Read more...] about Creative Business – Tie Society

Money

Living Within Your Means

When we purchased our first house we put down a large down payment. Our realtor was surprised to find out we didn't have any other debt. Getting the loan was no problem as we bought quite a bit less house than what the banks said we could afford. This all seemed normal for us--we try to live within our means if not a little below it. Several years later the realtor stopped by to say hi. He said, "You and your wife were really an inspiration to me. We've started paying off our debt and trying to get our living expenses under control." Evidently his normal customers weren't people who lived beneath their means. When you spend less than you make, you are buying flexibility and freedom. … [Read more...] about Living Within Your Means

You Are Self Employed

I was recently talking with a friend who said he'd be scared to try to start his own business because it seemed so insecure. I asked, "How is that any different than what you do working for someone else?" After a moment's pause, he admitted that it really wasn't. When it comes down to it, you work for yourself, regardless of who is the owner of the company that cuts your check. It is your responsibility to market yourself, develop your skills, identify trends and position yourself to profit. Abdicating these responsibilities doesn't somehow put you into an "employee" category where you have more job security. Most successful people see their jobs like this. They are in a business … [Read more...] about You Are Self Employed

Holiday Shopping Challenge

Last week I got an email from someone at American Express asking if I'd be interested in doing some Christmas shopping (at their expense) and blogging about it. To really make it enticing, the offered to give a $250 gift certificate away to a reader of Productivity501. (See below for details.) So here is the plan. In this post I'm going to discuss some strategies for getting the most out of your credit card benefits and rewards programs--particularly related to Christmas shopping. I'll use American Express as an example, but most everything will relate to other cards as well. Then I'm going to try to buy 5 gifts for family and follow up with a post on what I found in a week. In that post … [Read more...] about Holiday Shopping Challenge

Setting Goals and Making Them Visible

When I was in high school, I wanted to get a computer. Computers weren't nearly as inexpensive as they are now days. The one I wanted represented about 15% of my fathers yearly salary at the time. It was much more expensive than what I could reasonably expect to save during the summer--even with taking on some extra odd jobs and saving every penny possible. I really wanted to have a computer when I started the next school year, so I decided to make that my primary goal for the summer. To help me focus on my goal, I set aside a savings account specifically for the purchase. Using my parents' typewriter, I created a thermometer style graph showing how much money I had saved and taped … [Read more...] about Setting Goals and Making Them Visible

American Express Concierge

American Express Concierge and Restaurants One of the best experiences I've had with American Express Concierge service was early in 2011 when spending a few days in Kansas City for my wife's birthday. On a whim, we decided to visit the Country Club Plaza and noticed a restaurant called Fugo de Chao. It is a place where they bring skewers of meat around through the dining area and cut off pieces at your table. My wife had been to one of their restaurants as a teenager in Brazil and had very fond memories. Unfortunately we were told that there was a 2 to 3 hour wait for "walk-ins". The staff suggested that we get our name on the list and check back in two hours to get a pager. We … [Read more...] about American Express Concierge

Free Tax Preparation Sites

With April 15th rapidly approaching, many will start looking for fast, efficient ways to file taxes. The IRS has partnered with a number of sites to provide free online filings. This helps the IRS by decreasing the number of paper forms they have to process. In most states you are still going to have to file a state return. If you plan to use software, it may be easier to do the Federal and State together at the same time. Still, for states without an income tax, this is an easy way to do your taxes and get them submitted for free. Here are a few free sites that offer free filing … [Read more...] about Free Tax Preparation Sites

Your Money or Your Life

A number of years ago, I was managing the IT department for a large non-profit and I had an opportunity to interview for a well funded startup airline. The airline was just launching and they were going to fly me out to New York to interview for heading up their IT support services. Their plan was to go public within a few years, which at the time looked like it would be very financially rewarding for the early employees. From a money perspective it looked like a great opportunity. However, the more my wife and I talked about it, the more we realized that we'd be trading a significant part of our life away for more money. While this wasn't necessarily a bad thing--everyone does this … [Read more...] about Your Money or Your Life

Understanding Taxes

When it comes to your finances, there are few things you can do that are as beneficial as really understanding taxes and keeping up with current tax law. Most people don't realize just how much they pay in taxes every year. The government is always coming up with various schemes to get you to do this or that and most of the time they try to motivate you by giving you some type of tax rebate or credit. In the past year, I've been able to save over $15,000 simply by paying attention to the changes tax laws and taking advantage of different credits, lower tax rates, etc. That may or may not seem like a lot of money, but considering the average household income where we live is in the … [Read more...] about Understanding Taxes

Self Directed IRAs

I've been learning a bit more about Individual Retirement Accounts and wanted to share a few things I've learned about how flexible IRAs actually are. Obviously talk to a qualified financial advisor before acting on anything you see here. If I got anything wrong, please let me know in the comments where everyone can read it. Most people think of IRAs as being something you can invest in stocks, bonds, mutual funds and that is about it. If you really look at the law, it is much more generic than that. In fact the actual tax law only lists a handful of things that IRA can not be invested in. Here is the list: Artwork Gems Antiques Coins Life Insurance … [Read more...] about Self Directed IRAs

Life Insurance

Shortly after my wife and I got married, I took out life insurance policy. When our second child arrived, I took out another policy just to make sure my family would be cared for if something were to happen to me. I started writing this post around that time and never got around to publishing it. When I heard the story below about two people I went to college with, it prompted me to dig this post out and go ahead and publish it. A few months ago, two brothers who I went to college with entered the hospital. The older brother had a liver problem and the younger brother was going to donate part of his liver. (Your liver is one of the only organs that will grow back.) I don't know exactly … [Read more...] about Life Insurance

Craigslist Negotiating Secrets

Depending on your point of view, Craigslist is a cesspool of junk or a treasure trove of riches. CraigsList can offer some great deals if you know how to negotiate effectively. I've been compiling a list of best practices to help buyers get the best deal from Craigslist purchases. The bulk of this article is going to focus on a process for getting the best price on CraigsList items based on my experience. In the second section, I go through an actual email exchange to show how to offer substantially less than the asking price without insulting anyone. In the remaining sections of this post, I'm going to look at some other aspects of buying off CraigsList including a look at … [Read more...] about Craigslist Negotiating Secrets

Money Myths

The older I get and the more people I meet, the more I come to realize that biggest thing that determines your level of financial freedom has to do with your beliefs about money. I'm not talking about the "if you think positive thoughts, you'll become rich" line of thinking. I'm talking about our expectations related to how we get money, what happens when we receive money, what are good ways to spend money, how you define wealth, etc. Here are some common myths about money: When I receive money, someone else loses it. From a total economic perspective, money represents productivity and productivity is not a zero sum game. A zero sum game is one where in order for me to win, someone else … [Read more...] about Money Myths

Borrow from your IRA

Usually I write about stuff that I recommend doing. In this post, I want to look at something that is possible, but not recommended under most circumstances. With hard economic times, there are a lot of people trying to find ways to borrow from their retirement funds. Many 401k accounts allow this, but what if your money is in an IRA? You'll probably want to ask: "Can I borrow from my IRA?" Well, can you borrow from your IRA? Or perhaps, can you borrow against your IRA's value? Technically, no. But there is a short-term loophole that you can use if you have no other option. In this post, we are going to explore the loophole. Individual Retirement Accounts An individual retirement … [Read more...] about Borrow from your IRA

Prepare for Next Year’s Taxes

With tax season behind us, it is worth taking a few minutes to prepare for next year. As the deficit rises, it seems pretty difficult to imagine that our taxes won't be going up in one form or another. A little preparation can help make sure that you pay no more than your fair share. Tax folder Start a folder today for 2010 tax papers. Even if you don't put anything in it, having it ready helps make sure that you don't accidentally misplace something when it does come in. Many people spend more time looking for tax papers than they do actually preparing their taxes. This folder is also a great place to keep anything that will help you with your taxes. If you read about a tax credit … [Read more...] about Prepare for Next Year’s Taxes

Diversified Income

Nearly everyone knows that, when it comes to investing, you shouldn't put all of your eggs into one basket. Investing in many different types of investments helps lower the risk that a downturn in a particular area will wipe you out, financially. (See the story about a man who only invested in street cars.) Most people don't take what is common knowledge about investing and apply it to other areas. In particular, they don't apply it to their income. When you are in a position where all of your income is determined by a single employer, you are just like the guy who had all of his money in street cars. Many dual-income families have some level of diversification by having two adults … [Read more...] about Diversified Income

Money Thoughts

Here is a short collection of money tips and thoughts as we reach the April 15th tax deadline. Homebuyers credit The home buyers credit expires after April 30. First time home buyers can get a $8,000 refundable credit and there is a $6,500 credit available for current home owners to buy a different home. April 30th is the deadline to sign a binding contract, but you have until June 30th to completely close the deal. Claiming the home buyers credit will force you to file on paper and your return will be subject to much closer inspection. The IRS plans to audit some 200,000 returns of people who took the home buyers credit so be sure to do your best to provide all the necessary … [Read more...] about Money Thoughts

Income Diversification

Most people make money from their job working for someone else, and that is it. This is an extremely precarious situation, because if the job goes away, it takes away 100% of their income. The ideal situation is a number of different income sources that can all be ramped up, if necessary. In this post, we are going to look at several different sources of income. Job This is where most people make their money. They work for an employer that pays them for their time. An advantage of this type of income is that the employee doesn't have to know much about running other parts of the business. They can concentrate on their portion of their job. A janitor at Google doesn't have to … [Read more...] about Income Diversification

Getting More Out of Your Job

Most people focus on their paycheck as the reward for their work. While it is true that this is a significant portion of what you get in exchange for your time and effort, there are often other benefits. Many jobs offer benefits like: Health insurance Life insurance Retirement accounts Financial planning services Training opportunities Tuition reimbursement Contribution matching Mentoring programs Corporate discounts Wellness & Fitness programs Not every job offers every benefit mentioned above, but I'm consistently amazed at how many people have no idea what their company offers. The best way to find out what is available is to get a copy of your employee … [Read more...] about Getting More Out of Your Job

Odds of Success

It has been years since I read Rich Dad Poor Dad, but one of the things I remember the most was the way Robert Kiyosaki said he approached starting his business. He knew that four out of five businesses fail, so he figured he should plan on starting 5 businesses in order to get one that succeeded. This is valuable thinking. When you approach your success goals with the idea that you will need to learn from some failures along the way, you can be much more realistic about what you are trying to achieve. It is also much easier to handle failure when you see it as part of your path to success. Failure should be a springboard to help you do better on the next try. But if you start out … [Read more...] about Odds of Success

10 Stages of Financial Freedom

0. You Earn Less than you Spend This is obviously a good place to avoid and represents the least amount of freedom. No one should be here, but I added it because I know many people (particularly in the US) operate regularly in this stage. 1. Your Job Covers Your Expenses This is where a lot of people are. You spend everything you make. At this stage, losing your job is a terrifying prospect because you are only a week or two away from being back in stage 0. A few more weeks, (depending on how long you can string out your credit cards) and you'd be looking at bankruptcy. At this stage, changing jobs is very risky because, if it doesn't work out, you have very little cushion to let … [Read more...] about 10 Stages of Financial Freedom

Email Receipts

Some people are going to consider this an ugly hack, so I've been hesitant to share it. However, it works very well, so here it is. When I get an email receipt, I simply leave it in my inbox. (As I've said before, I don't worry about trying to delete everything out of my inbox--I just keep everything I might need in there where I can easily search it.) So, all of my email receipts are in my inbox. When I import my credit card statement into my financial software, I like to add a note on each item saying what it was for. I've found that the most efficient way to find the receipt is to do a search in my email program for the price. Most of the time this is a unique number, and I … [Read more...] about Email Receipts

Working with Your Spouse Financially

In the book The Millionaire Mind and The Millionaire Next Door, the authors point out that millionaires tend to marry people who support them financially. One of the easiest ways to wreck your financial plan is for there to be competition between a husband and wife, financially. If you have ever heard a couple say things like, "well, you bought a new dvd player, so I can go buy a new dress" or "you spent $300 at the mall, so I decided to go buy a new television." You know what I'm talking about. If the members of a marriage feel like they are in competition with each other for spending, they are off to a bad start. Here are some simple tips to avoid this type of … [Read more...] about Working with Your Spouse Financially

Starting a Business in a Down Economy

A friend of mine is starting a business selling Cupcake Towers. When I first heard what she was doing I thought, "Why would you want to start a business right now?" After further consideration, I realized that if you have a good product or service, now might be the best possible time to start a business. Here is why: There is less competition for workers right now so you can get good help for a reasonable cost. If you have a business idea that you can run on the side, it makes sense to start before you quit your day job. Technology has drastically reduced the cost of running a business. You can get a web store up for $20 to $40 per month (sometimes even less). If you want to … [Read more...] about Starting a Business in a Down Economy

Upper, Lower and Middle Class Tax Breaks

Many people feel that rich people don't pay enough taxes. The question of what type of tax structure is best for the economy isn't something I want to address in this post. Instead, I'd like to talk about the idea that rich people pay less in taxes than the poor and middle class. Part of this view is rooted in what people see as the purpose of taxes. I see the government as providing a very valuable service to me. They keep the infrastructure running and create the rules and environment that allow me to live happily and run a profitable business. I am happy to pay taxes to support the police and military to keep me safe, pave roads to drive on, help prevent the outbreak of horrible … [Read more...] about Upper, Lower and Middle Class Tax Breaks

14 Must-Have Online Banking Features

Our daughter just turned 3 months old. She has already visited 10 states and she's spent 1/3rd of her life on the road with us. My point is, we travel a lot. We need to be able to manage our finances from anywhere in the world. Rich online banking services are much more important than a physical location. Since I have been doing all of my banking online with quite a few different online banks as I looked for the best solution, I've had a chance to really experiment with what works and what doesn't work for us. Here is a checklist of things to look for in an online bank. Some items you may be familiar with. Others might be new to you if it isn't something your current bank … [Read more...] about 14 Must-Have Online Banking Features

Saving Money on Cooling Your Home

Dealing with the summer heat can be pretty expensive. The colder you need to keep your house, the more it costs. Here are some tips to help you stay cool at home more efficiently. Dress light - Make sure you are wearing cool clothing in your home. Wearing long sleeves and warm pants is going to force you to keep the temperature colder to stay comfortable. If dressing in cooler clothes lets you turn the thermostat up even just a single degree, it can still result in significant savings. Take off your shoes - This is related to dressing light, but if your feet are cool, it is much easier to feel cool all over. A cheap pair of sandals to wear inside can pay for themselves very … [Read more...] about Saving Money on Cooling Your Home

Don’t Depend on Your Job

I see a lot of people who become overly dependent upon their job. This isn't surprising and it's very easy to do--particularly with highly motivated performance oriented individuals. However, if your entire identity, self-worth and financial resources are tied up in your job, you are setting yourself up for catastrophe. I'm not saying you shouldn't be proud of your work or enjoy your job, but I am saying that you shouldn't let yourself get blinded to all these economic realities. No matter how good you think you are, you can be replaced. This is true now more than ever. In fact, if you are an extremely high performer and are being paid commensurate with your capabilities, your salary … [Read more...] about Don’t Depend on Your Job

Cost of a New Computer

It is very easy to underestimate the cost of a new computer. The cost of purchasing a computer is relatively straightforward. You pay the price that on the sticker. However, there are two other areas of cost that are often overlooked. Let's briefly look at each of them. Maintenance costs Computers are like cars. They have a finite life and at some point it is very likely that they will both need repair. The older they are, the more likely it is they will need repair. When people buy computers, they often focus on the sticker price and not the total lifetime cost. The one year warranty that comes with a computer automatically may be a lot cheaper than the three-year coverage, but how … [Read more...] about Cost of a New Computer

Productive Finances Checklist

Here is a checklist for your financial productivity. Most of these things seem minor, but taken together, they really add up and can make a big difference in how efficiently you are using your time and money. Are you using direct deposit for your paychecks? -- If you are still manually carrying a check to the bank or putting it in the mail, stop! Direct deposit will get your money to the bank faster so you start earning interest as soon as possible. Even if it only saves you 5 minutes every two weeks, that is an extra 2 hours each year you can spend on something more important. Is your money in the bank earning at least 4% interest? -- If not, look for a different account. There … [Read more...] about Productive Finances Checklist

Why You Need Personal Capital

I've been exploring several business opportunities recently, so I've been thinking a lot about capital. If we want to do X it will take $1500 of capital. If we want to do Y it will take $4000 of capital. Our options in business greatly depend on the amount of capital we control. Capital represents the ability to do something. Better yet, it creates an option for you to choose a particular path. Without enough capital, that particular path is not available to you. When it comes to our personal performance, capital is an important concept. True, we don't usually call it capital, but if you think in terms of that which gives you options, it functions in the same way. You have to … [Read more...] about Why You Need Personal Capital

Fewer Financial Institutions

Last year I finally got fed up with all the statements I was getting from various financial institutions. I had retirement accounts with 4 or 5 different companies and stock accounts with 2 or 3 others. It was very difficult to keep track of what was doing well and what was doing poorly. I finally settled on two institutions; one for retirement type accounts and one for my non-retirement savings, checking and investments. I contacted both institutions and gave them a list of what I wanted to move over. On the retirement side of things, the transition went very smoothly. They filled out all the paperwork, sent it to me for my signature and I FedExed it back to them. The … [Read more...] about Fewer Financial Institutions

Keeping Your Stuff Safe

The other day, I stepped outside and found my neighbor lugging a broken door out of his garage and into the back of his pickup truck. It turns out he had locked himself out of his house. His wife was away and he had no spare keys. To make matters worse, their new puppy was inside the house. He simply kicked the door in, got his keys and then went and purchased an identical door, which I helped him install. Later on that day, I was talking with some other neighbors who are both police officers. They were staring at the mangled door next to the curb and wondering what happened. They commented that the doors and locks on our houses don't really keep our possessions safe. For the … [Read more...] about Keeping Your Stuff Safe

Cost Savings Options

In today's economy, there aren't a whole lot of jobs that are completely safe from company cut-backs and layoffs. Though your job may be safe, saving extra money for emergencies is always a good idea. Here are some frugal ideas that might help with the saving: Food Try not to eat out. Food prepared at home is often better for your health, anyway. Turn leftover food into new dishes everyone will like. Lots of things can be made into soups or stews. Learn to make your own coffee/lattes instead of having to pay $4. Try drinking water instead of other beverages. It is much cheaper and can help prevent some health problems, helping you save on future medical bills. Angel Food … [Read more...] about Cost Savings Options

4 Reasons You Should Use a Credit Card

When you pay off the balance each month, most credit cards don't charge you anything. This can be one of the best ways to manage your finances. Below are four reasons you should consider using a credit card. 1. Avoiding Fraud Debit cards and checks are some of the worst ways to pay for anything. Sticking with credit cards or cash can save you a lot of money. Pretty much anything you do involves risk. When you carry around $50 in your pocket, there is a risk that you might lose it or get robbed. When you give a credit card to a waitress, there is a risk that she might steal the number. When you write a check at the grocery store, there is a risk that someone might take your … [Read more...] about 4 Reasons You Should Use a Credit Card

Mind Your Own Business

Begin Unrelated Story: I was talking with an employee who works for Mind Your Own Business--a company that makes small business accounting software. She was relating a time she had been pulled over by a policeman who asked her the standard questions, "where are you going?", "where do you work?". When asked where she worked, she replied "Mind Your Own Business". The cop was kind of surprised and started to explain that it would probably be better to cooperate. She had to pull out her business card to prove that she, indeed, worked at Mind Your Own Business. End Unrelated Story Okay, back on track. When you do work, you are providing value to someone. Actually, you are providing … [Read more...] about Mind Your Own Business

Wrong Side of the Tracks

The town where I live has a railroad track running through middle. In general, the nicer houses are on the West side of the town and the older, more run down houses are on the East side. Our evening entertainment usually consists of going for walks down the brick-paved streets. The town is small, so you can cover a significant portion in a few 3 mile walks. One thing we've noticed is that the average number of dogs per house on the less affluent side of the tracks is much higher than on the wealthy side of the tracks. On the East side, it is common to see 3 or 4 dogs staked out together in a small yard. On the West side of the tracks, people still have dogs, but it is rare to see … [Read more...] about Wrong Side of the Tracks

Layoff Preparation

With knowledge of our country's current economic situation being broadcast ubiquitously across the news, it is hard to ignore the fact that the economy is slowing down. Jobs that seemed secure are now not so solid, and many employers are beginning to cut costs in any possible way they can. Unfortunately, one of the top trends seems to be downsizing with regard to personnel. Though it is always hard to deal with layoffs, there are ways to prepare for one and devise a strategic plan in case the worst happens. Recognizing the signs Though it may not always be the case, sometimes employers give unintentional information about who they are going to have to let go. Here are a few that … [Read more...] about Layoff Preparation

An Economist’s View of College

Many high school students leave their hometowns with bright ideas and big dreams about what they will do in and after college. For most Americans, a bachelor's degree in a solid field is a worthy goal. Being a college student, myself, I often hear students talking about how wonderful post-college finances will be and how wonderful it will be to drive a reliable, new car and eat real food again. However, since the current economic situation is a bit bleak, tuition costs are under the constant scrutiny of parents and students that working their way through college. SmartMoney produced a study discussed in an article that analyzes the actual return on getting an education. Bargains vs. … [Read more...] about An Economist’s View of College

Tips for Taxes

Here is a round up of useful tax tips as we get into the tax filing season. IRS Presents-Top Ten Tax Time Tips - This article explains some time saving measures that can help the filing process be more efficient and streamlined. 3 New Tax Changes - These tips could be useful for those that haven't yet taken a look at the recent changes in filing taxes. 6 Tax Tips for Tough Times - The advice in this article may be especially helpful for those that have recently lost jobs or other sources of income. Tax Tips for Small Businesses - This article contains money-saving information particularly relevant for small businesses. Retiring: Tax Tips - For those that have reached retirement … [Read more...] about Tips for Taxes

Five Simple Things I Like

When it comes to money, many people get into trouble because they haven't figured out what they really enjoy. I've seen people buying all kinds of things that others enjoy without taking anytime to think about what is important to them personally. Just because your neighbor enjoys playing the piano doesn't mean you will achieve the same happiness by dropping $8,000 on a nice instrument--especially if you don't know how to play. Sometimes it is the little things that really help make a difference in your happiness. I'm not trying to say that stuff=happiness, but it does make sense to at least think about the things you like. Here are five simple things I've discovered that I really … [Read more...] about Five Simple Things I Like

Expect Change

Years ago there was a millionaire who was getting old. He decided he wanted to provide for his heirs, but he wanted to protect them from poor investments that would make them lose the fortune he had built up. He had his lawyer draft his will in a way that would provide for his heirs, but only allow his money to be invested in a reliable, solid industry. The industry he chose was electric street cars. Within a generation, his descendants were pumping gasoline at service stations. The millionaire had good intentions, but he was short-sighted. His basic failure was that he didn't expect change. He correctly assumed that people would always need cheap transportation. He incorrectly … [Read more...] about Expect Change

Math Impaired

I've been following the news about the sub-prime markets and foreclosures in the US. In a nutshell, here is what has happened. Companies that lend money for house loans had been doing very well, but their customer base was shrinking--there are only so many homes you can sell to one person.To compensate they started trying to sell to people who wouldn't normally qualify for a home loan. For example, some companies would get a list of people who had recently had their cars repossessed and use that as a list of potential clients. (I've written a more detailed explanation of the subprime mess in a previous post.) This is kind of what Citibank did in the 90s by offering credit cards to … [Read more...] about Math Impaired

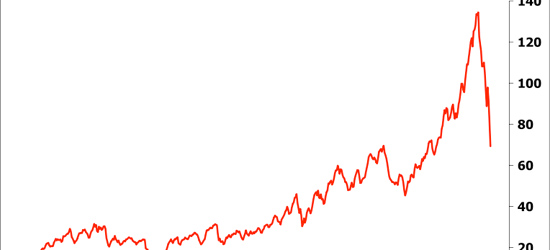

Benefits of Expensive Oil

Most people are concerned about the high cost of gasoline. The countries that produce oil are, of course, thrilled. In the Middle East, people are paying millions of dollars on car license tags with unique numbers. Evidently, having a Rolls Royce isn't enough to make you stand out over there. Saeed Khouri paid $14 million dollars to be able to put a license tag containing "1" on his car. People living in the US and other countries that are primarily consumers and not producers of oil are less fond of the current pricing trend. However, in an effort to always discover the silver lining, we are going to look at some of the potential benefits of expensive oil. Technological … [Read more...] about Benefits of Expensive Oil

FDIC Insurance – When Banks Fail

This post was originally published October 29th, 2007. I'm bumping it up because in today's financial climate it is extremely important. If you have any experience in dealing with getting money back from FDIC, please read the comments. Several people are having problems getting their money. Any advice you can give would help them out. Recently NetBank was shut down by the FDIC. The FDIC was created to prevent runs on the bank. They insure your accounts so even if the bank goes under, you will get your money back out. In exchange the bank gives up some control. The FDIC can come in, inspect things and force the bank to sell out to another financial institution if the FDIC doesn't … [Read more...] about FDIC Insurance – When Banks Fail

Lowering Gas Prices

While visiting relatives last week I saw some television. Since we don't have a TV hooked up to watch any type of broadcast programming, it was interesting to see some of the things that are on now days. On one show (I think it was the O'Reilly Factor) the host was interviewing someone who had written a book about oil, oil prices or something like that. The host kept asking the guy "so who sets the price of oil." The author tried to explain that it was a market, but the O'Reilly didn't seem to get it and asked, "so does OPEC set the price of oil?" Then I saw on the news that several presidential candidates are contemplating a gas tax holiday during the summer months. This leads me to … [Read more...] about Lowering Gas Prices

Six Tips for Eating Out Frugally

Most of the time, people go out to eat, not just for the food, but for social and entertainment purposes. These six suggestions will help you get the experience at a "discount". Order water - In the US, you'll usually pay $1 to $3 for a soft drink with your meal. Water is healthier and can often reduce the cost of your meal by 10% to 20%. Go out for lunch - Many places charge more for the evening meal than for lunch. Sometimes the evening portions are bigger, but this isn't always the case. If you go out for lunch you'll often save 35% to 50% on your meal. (This seems to be particularly true for Chinese restaurants.) Go out just for dessert - Eating at home and going out for … [Read more...] about Six Tips for Eating Out Frugally

Bank Mistake

I have a bank that didn't get my last change of address notification. When the mail was returned to them, they found my address and sent it to me along with a note telling me to change my address with them. The odd thing was along with my statement were 5 other statements from people I don't know. I called them and confirmed the address change and mentioned the other statements. They said they would take care of it. The other day I got my next statement--and the statements from 5 different people I've never heard of. I don't mind getting other people's statements. However, I'm very concerned that some of my statements may be sent to total strangers. This is one advantage of online … [Read more...] about Bank Mistake

Reader Question – Getting Your Money

How do you get money back from someone who owes you? Generally if you are asking this question, you've probably made a mistake somewhere. Here is a list of rules I follow for loaning money. Never loan money to friends or family that you can't afford to lose. If you can't forgive them the debt without holding it against them, you are not the person who should be loaning them money. Do everything in writing. Don't expect to remember the terms of the loans. Get it in writing and signed. Make sure you have terms listed to handle the case where they don't pay. This could be listing an item as collateral, late payment fees, etc. You need to leave yourself an out if they don't pay. Be … [Read more...] about Reader Question – Getting Your Money

Asking for a Discount

One way to realize great savings is to simply ask for a discount. For example, when we were getting ready for our daughter to be born we asked the hospital if we could have a discount for paying the entire fee up front. They gave us 20% off what we would have paid otherwise. I've generally had good luck asking for discounts. Here are some tips to follow: Make sure you have something to offer - If you can pay in cash, but in bulk or offer some other type of incentive it is easier for the person selling to want to negotiate with you. Be prepared to walk away - If the sales person realizes that you might not make the purchase you have much better bargaining power. I've had car … [Read more...] about Asking for a Discount